Changes to VAT Penalties & Interest Charges in 2023 Explained

In line with the recent changes HMRC have made with Making Tax Digital and in order to introduce a fairer system for those who are generally compliant, HMRC has announced a new VAT penalty system for late submissions and payments. It is hoped that the new system, which comes into effect on the 1st of January 2023, will reduce the number of taxpayer challenges by introducing a scale of severity. In short, those who narrowly miss deadlines will be treated lightly, while those who frequently miss deadlines and fail to pay and submit promptly will face harsher penalties. We’ve digested the upcoming changes and summarised them in this easy-to-follow guide.

Late VAT Submissions

HMRC have announced that late submission penalties will work on a points-based system. Each late VAT submission will accrue one penalty point. Once a point threshold is reached, a £200 penalty will be charged. An additional £200 penalty will be charged for each late submission thereafter. Late submission penalties also apply to NIL returns and repayment VAT returns.

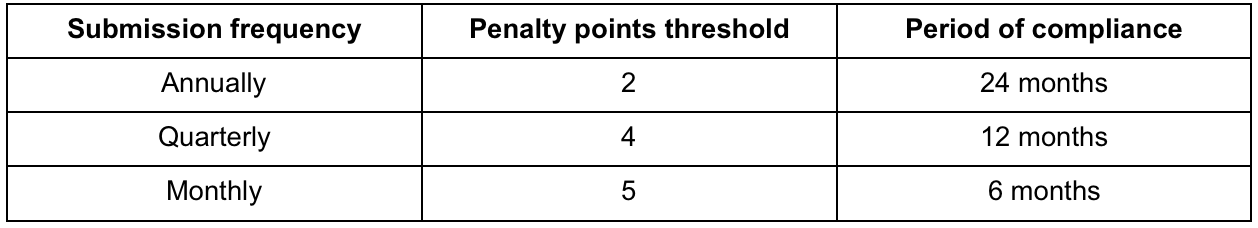

The points threshold depends on how frequently you submit VAT returns.

In order to ‘reset’ your penalty point count to zero, you must complete a ‘period of compliance’. This is a length of time where all VAT returns are submitted on time. In addition to completing the period of compliance, you must also pay all outstanding returns due for the previous 24 months.

Late VAT Payments

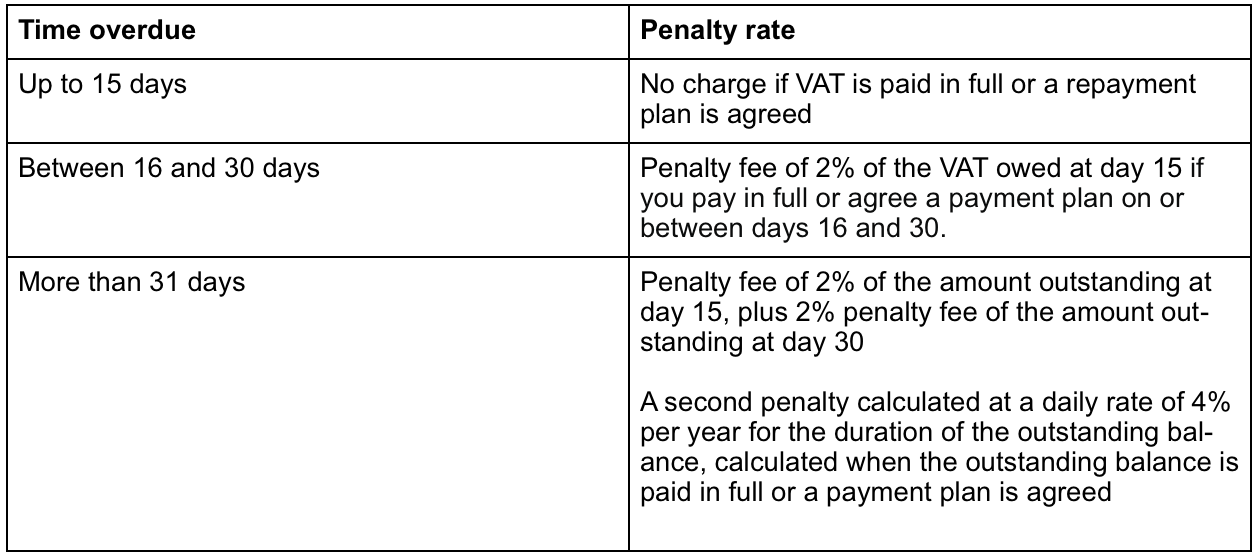

The penalty system for late payments increases in severity the later a payment is made. This change to the system is intended to be fairer to those who narrowly miss the deadline and more penal to those who continually fail to pay.

Changes to Interest

HMRC will charge interest on overdue tax from the due date at the Bank of England base rate plus 2.5%. This will continue to accrue even when a repayment plan has been put in place.

The process is also changing when you overpay tax. Instead of the repayment supplement, from the 1st of January 2023 onwards you will receive repayment interest at the Bank of England base rate minus 1%. According to HMRC, ‘the minimum rate of repayment interest will always be 0.5% even if the repayment interest calculation results in a lower percentage’.

How long is the ‘Period of Familiarisation’?

HMRC have announced that from the 1st of January 2023 to the 31st of December 2023, they won’t charge a first late payment penalty as long as the payment is made within 30 days of its due date. This is in order to give people time to adjust to the new system.

What to do if you can’t pay VAT on time

If you are unable to pay your VAT returns on time, the best option is to get in touch with HMRC and arrange a ‘Time to Pay Agreement’. If agreed, standard interest charges on late payments will be frozen from the plan is agreed as long as you keep up with the agreed payments set out in the plan.

Comprising a team of highly skilled and experienced payroll professionals, Finesse Resources specialises in delivering payroll services to businesses of all sizes throughout the UK. Find out more about our services and the sectors we specialise in at www.finesseresources.co.uk.