July’s National Insurance Changes Explained

It’s rare in these times of soaring inflation to be talking about a decrease in National Insurance payments, but that’s exactly what’s happening here in the UK. It comes as a result of increased National Insurance thresholds that are taking effect on 6th July 2022, following rate increases brought in at the beginning of the tax year on 6th April 2022. In this article, we’ll explain the benefits for your employees and the need-to-know information as an employer.

When are the thresholds increasing?

On 6th April 2022, employees began paying an extra 1.25% in National Insurance as rates were increased in line with a series of changes to the UK tax system. The increase was a result of the new Social Care Levy brought in to help ease the strain on the NHS and “equivalent bodies across the UK”.

In his Spring Statement, Chancellor Rishi Sunak announced an increase in the Primary Threshold for Class 1 National Insurance from 6th July 2022 bringing it in line with the Standard Income Tax threshold, otherwise known as the Personal Allowance.

How will employees be affected?

The average employee in the UK will save £330 per year as a result of the National Insurance threshold change on 6th July 2022.

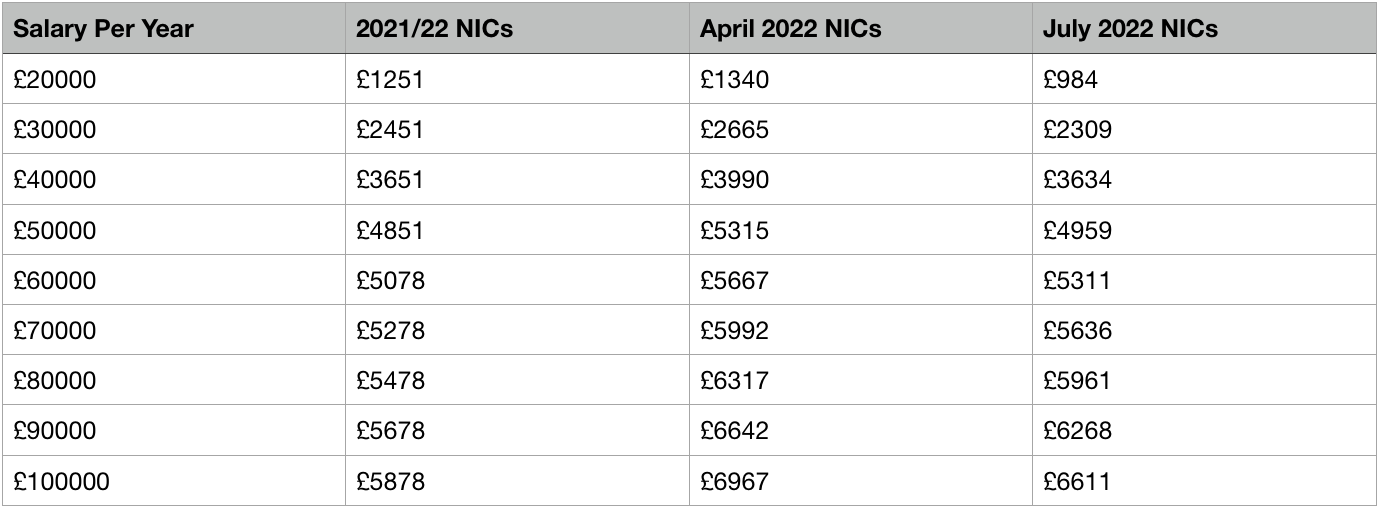

This welcomed change will benefit those on low incomes most, with employees paying less than they did last year, this means those earning less than £12,570 per year won’t pay National Insurance and those earning over the threshold will pay less. High earners (over £50,270 per year) will save money compared to the changes introduced on 6th April 2022, however, they should still expect to pay more National Insurance than they did last year.

The below table displays the changes according to an employee’s salary.

National Insurance for employers

From 6th April 2022, employers saw an increase in the rate of National Insurance they had to pay per employee from 13.8% to 15.05%. The minimum income threshold also increased from £8,840 per year to £9,100 per year.

The exceptions to the 1.25% increase per employee are as follows. The rate at which employers will have to pay National Insurance for the below employees will remain at their previous level.

-

Apprentices under 25

-

Employees under 21

-

Armed forces veterans

-

Employees in Freeports (areas free from certain trade taxes) who earn less than £25,000 per year

Finesse Resources are experienced payroll professionals trusted by businesses throughout the UK. If you would like to find out more about our services, get in touch on 03303 201 924 or contact us using this form.