UK Tax Rates & Thresholds for 2023/2024 (Full Breakdown)

With the Spring Budget set to be announced, we’ve rounded up a comprehensive guide to all of the tax rates and thresholds in the UK ahead of the new fiscal year beginning on the 6th of April 2023. This includes tax bands, allowances and other important rates like the National Minimum Wage and Statutory Sick Pay.

View our printable breakdown of UK tax rates and thresholds for 2023/2024

Want a quick answer to your question? As well as the complete downloadable guide, we have rounded up some of the most frequently asked questions regarding tax rates and thresholds below.

TAX RATES

When is the UK tax year for 2023/2024?

The UK tax year for 2023/2024 starts on the 6th of April 2023 and runs until the 5th of April 2024. Each tax month begins on the 6th of the month and ends on the 5th of the following month.

What is the tax-free allowance in 2023/2024?

The standard tax code for employees in England and Northern Ireland for the tax year 2023/2024 is 1257L (S1257L in Scotland and C1257L in Wales). This is unchanged from 2022/2023 and is expected to remain unchanged until 2026. This means that employees can earn £12,570 before having to pay tax on their earnings.

What are the tax bands in England, Wales, and Northern Ireland in 2023/2024?

- Employees will pay a Basic Rate (20%) of tax on earnings between £12,570 and £50,270

- Employees will pay a Higher Rate (40%) of tax on earnings between £50,271 and £150,000

- Employees will pay an Additional Rate (45%) of tax on earnings over £150,000

What are the tax bands in Scotland in 2023/2024?

- Employees will pay a Starter Rate (19%) of tax on earnings between £12,571 and £14,732

- Employees will pay a Basic Rate (20%) of tax on earnings between £14,733 and £25,688

- Employees will pay an Intermediate Rate (21%) of tax on earnings between £25,689 and £43,662

- Employees will pay a Higher Rate (42%) of tax on earnings between £43,663 and £125,140

- Employees will pay a Top Rate (47%) of tax on earnings over £125,140

THRESHOLDS AND PAY RATES

How much does an employee need to earn to pay back their student loan in 2023/2024?

The monthly threshold for paying back student loans depends on which student loan plan they belong to. Here’s a guide to working out which student loan plan an employee is on.

- The monthly threshold for a student on Plan 1 is £1,834.58. Student loan repayments are charged at 9% for earnings above this amount. This equates to an annual salary of £22,015

- The monthly threshold for a student on Plan 2 is £2,274.58. Student loan repayments are charged at 9% for earnings above this amount. This equates to an annual salary of £27,295

- The monthly threshold for a student on Plan 4 is £2,305.00. Student loan repayments are charged at 9% for earnings above this amount. This equates to an annual salary of £27,660

- The monthly threshold for a student on a Postgraduate Loan is £1,750.00. Student loan repayments are charged at 6% for earnings above this amount. This equates to an annual salary of £21,000

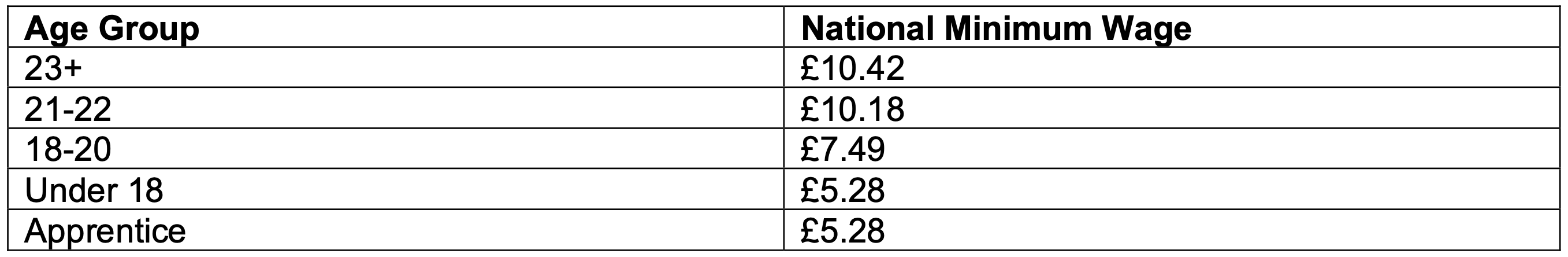

What is the National Minimum Wage in 2023/2024?

The National Minimum Wage increases as of the 1st of April 2023. The below table details the rates to be used per age group from this date.

What is the Statutory Sick Pay in 2023/2024?

The weekly rate of Statutory Sick Pay (SSP) in the tax year 2023/2024 is £21.88 per day, which equates to £109.40 per week. 109.40.

What is the Statutory Maternity/Adoption Pay in 2023/2024?

The weekly rate of Statutory Maternity Pay/Statutory Adoption Pay (SMP/SAP) in the tax year 2023/2024 is £172.48.

What is the Statutory Paternity Pay in 2023/2024?

The weekly rate of Statutory Paternity Pay (SPP) in the tax year 2023/2024 is £172.48.

Need help with your payroll? Talk to Finesse Resources

At Finesse Resources, we understand the challenges businesses face when managing their payroll. That's why we offer bespoke packages to businesses of all sizes, taking the hassle out of payroll processing. With our experienced team of professionals, we ensure your payroll is accurate, compliant, and on time so you can focus on your core business activities. Our range of services includes payroll processing, tax calculations, and compliance management, and we are committed to providing exceptional customer service.

So if you're looking for a reliable payroll service provider that takes care of everything, contact us today.