Statutory Payments Services

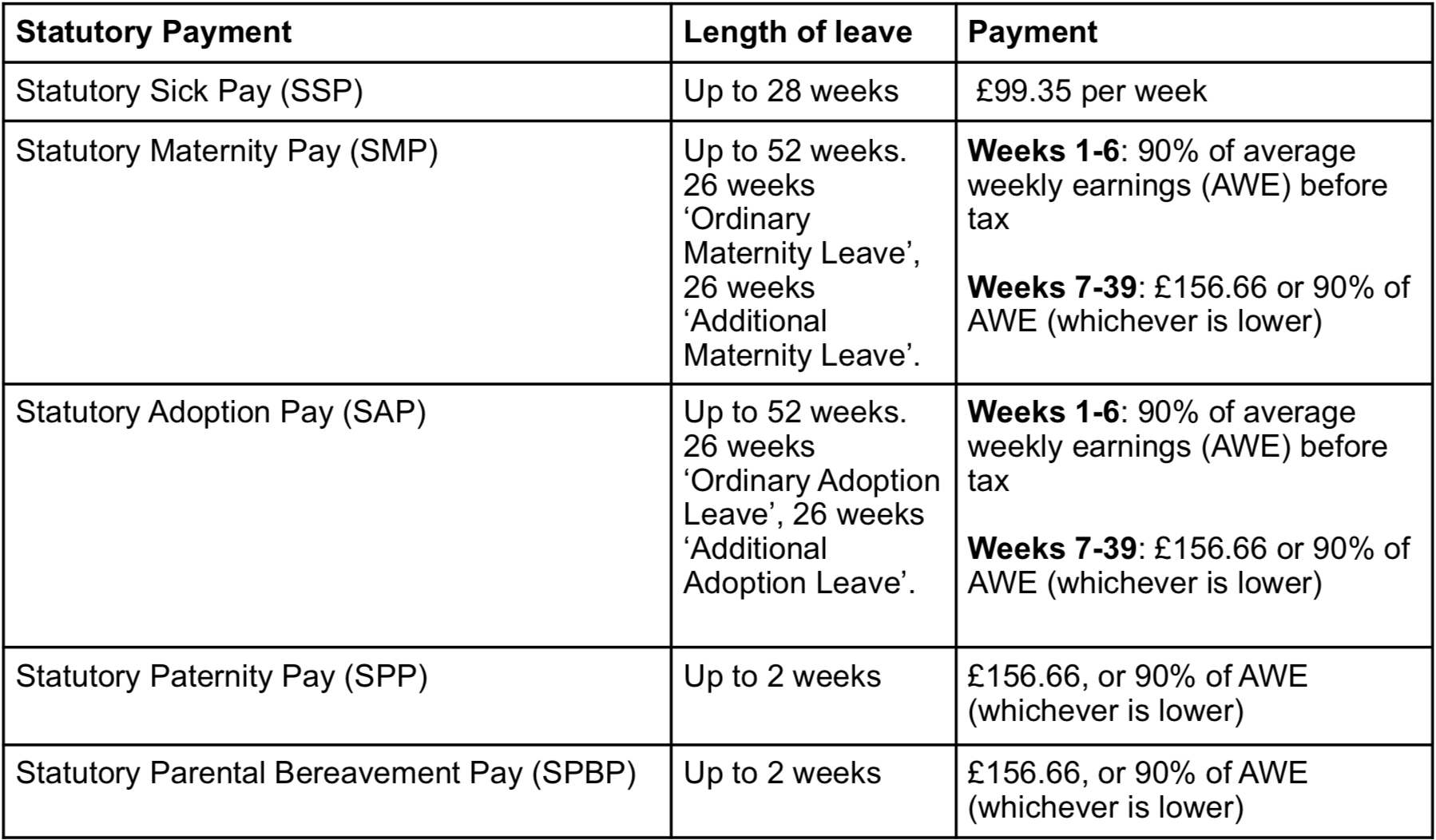

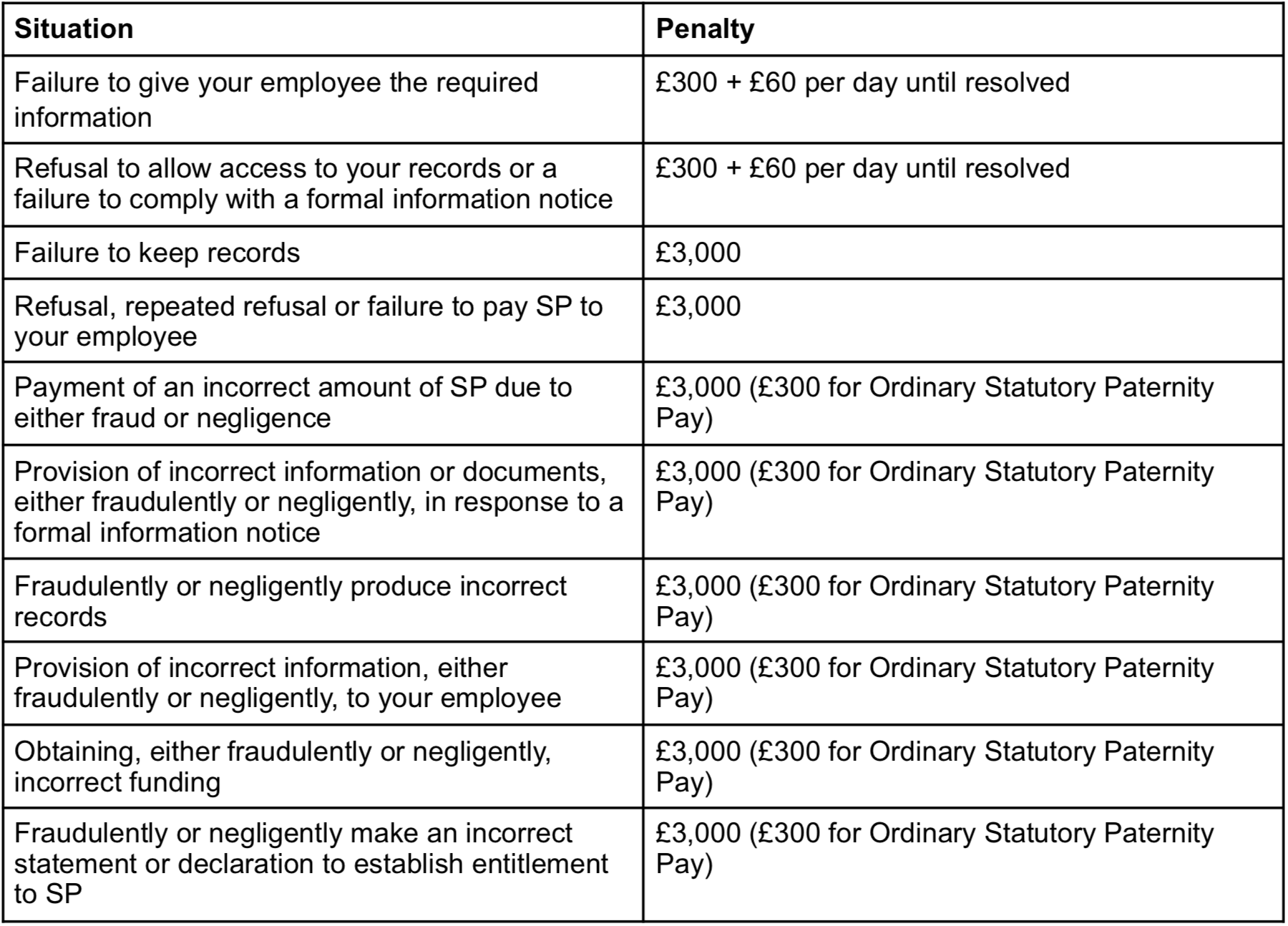

Statutory payments are a legal requirement for all UK businesses. As an employer, it’s your job to

identify when an employee’s absence qualifies and to ensure they receive the right payments. At

Finesse Resources, we can handle all your payroll commitments including statutory payments as your

chosen payroll partner.